Understanding Your Cash Flow Landscape

A healthy cash flow is crucial for business success. Companies need to carefully track revenue, manage expenses, collect payments on time, and maintain enough available funds for daily operations. Let’s explore the main challenges businesses face with cash flow and examine how economic changes affect their liquidity – the ability to cover short-term obligations.

Identifying and Adapting to Cash Flow Challenges

The first step to better cash flow is understanding what affects it. This means taking a close look at how your business operates – from sales and marketing to purchasing and operations. When you see how these areas connect, you can spot potential problems early. For example, if sales suddenly increase, you might need more money upfront for materials, which can temporarily reduce your available cash.

Small and medium businesses often struggle with cash flow. Research shows that 9 out of 10 SMEs in the UK worry about cash flow issues. The typical business faces cash shortages for four months each year. For 23% of SMEs, this extends to six months or longer, while 94% deal with negative cash flow at least one month annually. Learn more here: How SMEs Can Improve Cash Flow Management. These numbers show how widespread cash flow problems really are.

Assessing Your Current Cash Position

Knowing your exact cash situation is essential. Keep track of key numbers like operating cash flow, free cash flow, and working capital. Many helpful tools can make this easier. Read more about smart financial planning here: How switched-on finance teams will be approaching peak season. By watching these figures closely, you can spot trends and fix problems before they get serious.

Common Cash Flow Challenges and Their Impact

Here are the main issues that can disrupt healthy cash flow, along with their effects on businesses:

| Challenge | Impact | Frequency | Risk Level |

|---|---|---|---|

| Late Payments from Clients | Reduced working capital, increased debt | Often | High |

| Unexpected Expenses | Depleted cash reserves, potential borrowing | Occasional | Medium |

| Inventory Overstocking | Tied-up capital, increased storage costs | Sometimes | Medium |

| Seasonal Sales Fluctuations | Unpredictable income, budget constraints | Regularly | Medium |

| Inefficient Collections Processes | Delayed payments, increased administrative burden | Often | High |

When you understand which cash flow challenges affect your business most, you can create specific plans to address them. This helps keep your finances strong and creates opportunities for growth and investment.

Mastering Modern Cash Flow Forecasting

Precise cash flow forecasting is essential for any business focused on growth and stability. By estimating future money movements in and out of your business, you gain clear visibility into your financial position. This enables proactive decision-making around potential cash shortfalls and growth opportunities.

Why Traditional Forecasting Methods Fall Short

Basic spreadsheets and historical data analysis alone can’t keep up with today’s business realities. Markets shift quickly, unexpected costs arise, and economic conditions change rapidly. For instance, supply chain issues can suddenly increase expenses, making static forecasts unreliable. This creates the need for more advanced forecasting approaches.

A 2024 Agicap study revealed concerning cash flow trends among UK businesses. Mid-market companies face an average of 14 major cash shortages above £50,000 yearly, with 37% experiencing these monthly. Poor forecasting often results in missed opportunities and high overdraft fees. See the full report here: CFO Study 2024: Cashflow Forecasts in UK SMEs.

Building Reliable Cash Flow Forecasts

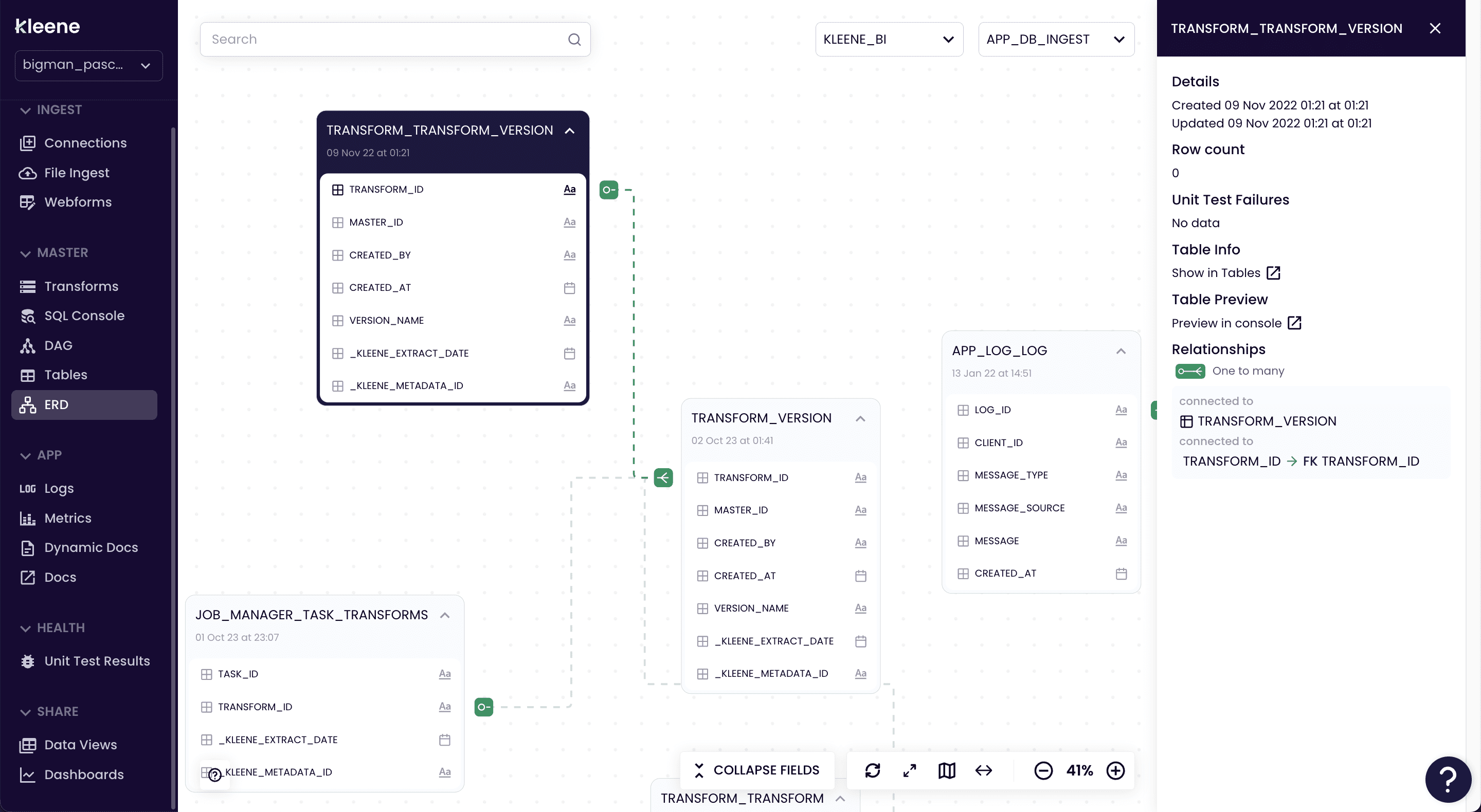

Modern forecasting combines data analysis, specialized software, and scenario planning. Tools like Kleene.ai help merge data from multiple sources for a complete financial picture. These tools help spot patterns that basic methods often miss.

- Data Integration: Connect your key systems – accounting, CRM, and others to gather complete data

- Predictive Modeling: Use AI and machine learning to project future cash flows based on past performance

- Scenario Planning: Create multiple forecasts (optimistic, pessimistic, likely) to prepare for different outcomes

Implementing a Forecasting System that Scales

Setting up effective forecasting requires more than just new tools. Your team needs to embrace data-based decisions and establish clear roles for managing and analyzing information.

- Start Small: Begin with basic forecasting and improve it as you grow

- Regular Review: Check forecasts often against actual results and adjust for market changes

- Collaborate: Include input from all departments to capture the full business picture

Following these approaches turns cash flow forecasting from reactive guesswork into a strategic planning tool. This helps you manage finances more effectively while spotting new opportunities for growth and stability.

Accelerating Your Payment Collections

Getting paid on time is essential for maintaining healthy business cash flow. While sending invoices is important, you need a complete strategy to encourage timely payments without damaging client relationships. This requires clear payment terms, consistent follow-up, and the right tools.

Setting Smart Payment Terms

Your payment terms establish expectations from the start. Clear communication helps prevent confusion and late payments.

- Shorter Payment Windows: Offer early payment discounts and use 15-30 day terms instead of 45-60 days. This helps improve cash flow.

- Multiple Ways to Pay: Give customers options like online payments, credit cards, and bank transfers to make paying easier.

- Crystal Clear Terms: Include all charges, due dates, and payment methods clearly on invoices. Explain any late payment fees upfront.

Getting these basics right sets you up for success.

Building an Effective Follow-Up Process

Even with clear terms, some clients will pay late. Having a systematic way to handle this is crucial.

- Automatic Reminders: Send automated emails before, on, and after due dates to reduce late payments.

- Personal Touch: For overdue invoices, direct phone calls or personalized emails often work better. This maintains relationships while addressing the late payment.

- Clear Steps for Late Payers: Create a process with increasingly firm reminders and consequences, but always stay professional.

Late payments significantly impact UK small businesses. Research shows 34% of SMEs use overdrafts because of late payments, spending about £4.4 billion yearly to chase them. Learn more: Cash Flow Statistics UK.

Using Technology to Improve Collections

Several tools can make payment collection simpler and more automated.

- Online Payment Tools: Add payment gateways to your invoicing so clients can pay instantly online.

- Invoice Automation: Use software to create, send and track invoices to save time and reduce mistakes.

- Data Analysis: Study payment patterns to spot trends and find ways to improve. Related reading: How to Master Inventory Turnover Ratio

Simple Psychology for Better Payments

Understanding how clients think about payments can help improve collection rates.

- Positive Messaging: Focus on benefits of paying on time like maintaining service access.

- Time-Limited Offers: Create urgency with special discounts for early payment.

- Show Success Stories: Share examples of smooth payment experiences to encourage others.

Using these approaches together can speed up collections, improve cash flow, and keep client relationships strong.

Strategic Pricing For Improved Cash Flow

Smart pricing decisions can directly boost your company’s cash flow. Finding the right price point means knowing both what your market will bear and what margins your business needs to thrive. The key is striking a balance that works for both you and your customers.

Recent data shows cash flow remains a pressing concern for UK small businesses. According to a Xero survey, 72% of small UK firms experienced cash flow problems last year, with 11% facing major challenges. Learn more in this cash flow trends analysis. These numbers highlight why getting your pricing right matters so much.

Value-Based Pricing: Focusing on Customer Benefits

Instead of just marking up your costs, think about what your product or service is truly worth to customers. What problems do you solve? How much time or money do you save them? For example, if your software eliminates hours of manual work, customers may gladly pay more than they would for a basic solution – even if your costs are lower. This approach can boost your margins while delivering clear value.

Competitive Positioning: Finding Your Price Point

While you need competitive prices, copying competitors can backfire. Study their pricing but focus on what makes your offering special. Highlight unique benefits that justify your rates. This helps avoid price wars that squeeze profits. Want to learn more about smart pricing? Check out this guide on AI-powered pricing strategies.

Timing Price Adjustments for Maximum Impact

When you change prices matters as much as the changes themselves. Consider raising rates during peak seasons when demand is high. For example, a summer tourism business might charge more in July and August. Just remember to be upfront about price updates – explain your reasoning to maintain customer trust.

Implementing and Testing Pricing Changes

Before rolling out new prices everywhere, test them with a smaller group first. Try different price points to see what works best. Watch how sales volumes and revenues respond. Keep monitoring results and adjust as needed based on customer feedback and business goals. Regular reviews ensure your pricing strategy keeps delivering results.

Building Your Financial Safety Net

A reliable financial safety net protects your business during challenging times and gives you the stability to pursue growth opportunities. Just like a safety net catches acrobats when they fall, having solid financial resources helps your business weather downturns and maintain momentum through difficulties.

Establishing an Emergency Fund

An emergency fund provides readily available cash to handle unexpected expenses or drops in revenue. Having this financial cushion can determine whether your business survives a crisis or faces major difficulties. The ideal fund size varies based on your industry, expenses, and typical revenue cycles. A good starting point is having enough to cover three to six months of essential operating costs, giving you a buffer against common issues like payment delays or emergency repairs.

Optimizing Working Capital

Working capital management focuses on efficiently using the funds available for daily operations. This includes carefully managing inventory levels to minimize storage costs while meeting customer demand. You might be interested in: How to master inventory optimization with data intelligence. Other key strategies include negotiating better payment terms with suppliers and improving invoicing processes to speed up incoming payments.

Diversifying Funding Sources

Depending on one funding source puts your business at risk – like relying on a single large client who could face financial troubles. Instead, explore multiple funding options to strengthen your position. Consider establishing credit lines, building relationships with several lenders, or looking into alternative financing like invoice factoring. Having various funding sources gives you flexibility and reduces vulnerability.

Recent economic challenges have made cash flow management especially important for UK businesses. The Bank of England’s 2020 research showed significant financial impacts from the pandemic. Learn more: Updated estimates of the cash-flow deficit of UK companies in a COVID-19 scenario.

Financial Resilience Strategies Comparison

| Strategy | Implementation Cost | Time to Impact | Risk Reduction |

|---|---|---|---|

| Emergency Fund | Moderate | Long-term | High |

| Working Capital Optimization | Low to Moderate | Short to Medium-term | Medium |

| Funding Source Diversification | Moderate | Medium to Long-term | High |

By implementing these strategies, businesses build a strong foundation that allows them to handle market changes and pursue growth opportunities. This proactive approach creates stability and confidence, helping businesses succeed in challenging times.

Your 90-Day Cash Flow Transformation Plan

Building better cash flow requires consistent, focused effort over time. This 90-day roadmap breaks down key actions into weekly steps you can measure and track.

Phase 1: Assess and Optimize (Weeks 1-4)

The first month focuses on understanding your current financial situation and finding quick wins for improvement.

- Week 1: Cash Flow Audit. Review the last 6 months of income and expenses. Map out patterns, high/low periods, and any cash shortages. Break down where money comes in and goes out.

- Week 2: Basic Forecasting. Set up a simple cash flow forecasting system – even a basic spreadsheet helps predict short-term needs.

- Week 3: Payment Collection. Examine your current invoicing and collections process. Find and fix any delays. Make it easier for clients to pay you.

- Week 4: Cost Review. Group expenses by category and identify areas to reduce spending without impacting core operations. Look for better vendor rates or service consolidation.

Phase 2: Implement and Automate (Weeks 5-12)

The second phase puts improved processes in place and adds helpful automation.

- Week 5: Payment Reminders. Set up automatic invoice reminders to go out before, on and after due dates.

- Week 6: Price Analysis. Review your pricing strategy. Does it match the value you provide? Are strategic price adjustments needed?

- Week 7: Funding Options. Research financing choices like credit lines or invoice financing if needed.

- Week 8: Stock Management. For product-based businesses, balance inventory levels to minimize costs while meeting customer needs.

- Week 9: Better Forecasting. Add more data points to your forecasting and create different business scenarios.

- Week 10: Client Messages. Make all payment-related communications clear and consistent.

- Week 11: Payment Trends. Use your data to spot payment patterns and identify consistently late payers.

- Week 12: Connect Systems. Link your key financial tools (accounting, CRM, etc.) for better visibility.

Phase 3: Refine and Grow (Weeks 13-12+)

The final phase focuses on monitoring results and planning for growth.

- Week 13: Safety Net. Start building an emergency fund – even small regular deposits add up.

- Week 14: Progress Check. Measure the impact of changes made so far. Keep what works, adjust what doesn’t.

- Week 15: Better Processes. Look for more ways to improve financial operations. Find additional automation opportunities.

- Week 16: Future Planning. Create longer-term cash forecasts and strengthen scenario planning.

- Weeks 17-90+: Keep tracking key metrics, adjusting strategies, and building financial reserves. Review and update your approach based on business results and market changes. This ongoing process helps maintain strong cash flow supporting your business goals.

Improving cash flow takes time and dedication. This 90-day plan provides concrete steps to make meaningful progress and build lasting financial strength. Want better financial insights? Kleene.ai provides powerful tools to help you analyze data and make smarter money decisions.