For e-commerce and SaaS companies, learning the Customer Acquisition Cost formula is crucial. This metric represents the total expenses incurred to acquire a new customer, encompassing everything from marketing and advertising to staffing costs. A balanced CAC is essential; if it’s too high, the company might need to increase prices or cut back on features, negatively impacting competitiveness and customer satisfaction. Conversely, a low CAC can indicate an opportunity to reallocate resources or adjust pricing strategies for better profitability. Recognising and strategically managing CAC is, therefore, fundamental to optimising sales and marketing strategies and ensuring sustainable business growth.

What is the Customer Acquisition Cost Formula?

A company’s CAC is the total sales and marketing cost that go into earning a new customer over a specific period. That cost is built up from marketing, advertising, staffing costs and other elements. Add all of those together, and divide it by the number of customers you acquired in a set period and you have the cost of acquisition.

So, CAC is the cost of converting people who respond to adverts and visit your store or site, to become a spending customer. It is a key metric for marketing and sales to understand the fundamentals of acquiring customers and is used with other metrics to see how much they spend as part of the customer journey and your value proposition.

Why is calculating customer acquisition cost formula is crucial for businesses?

All companies need profit and if your CAC is too high, then your marketing efforts are eating into profit margins. Reducing the CAC will make the business more sustainable and deliver better results, while allowing for more funds for other marketing campaigns or product development.

How do you calculate CAC?

As mentioned, CAC is the sum of all sales and marketing costs divided by the total number of new customers during a defined period. The cost base is built up from the various expenses for your marketing efforts, including salaries, design costs, advertising fees and so on. They need to be measured as accurately as possible to deliver an accurate CAC.

Revisit CAC calculations and costs on a regular basis to track marketing growth and how the impact of your CAC encourages or forces you to change your approach to acquiring customers.

How do marketing and advertising expenses affect Customer acquisition cost?

The total CAC will rise and fall periodically as marketing expenses increase during key selling periods, such as the new tax year for SaaS firms as customers’ budgets are released, and seasonal selling periods like Thanksgiving, Black Friday and Christmas for retailers.

Office and staffing costs might also grow as the business expands,or your use of freelance designers, marketers and software increases. Same goes for advertising costs, notably in competitive markets where there is lots of activity, pushing the prices of adverts or bids up.

What is the difference between direct and indirect costs in Customer acquisition cost?

The indirect costs associated with CAC are your general business costs, such as staff wages, office overheads including equipment.

Direct costs are those relevant to the cost of adverts, such as your marketing software subscriptions, the cost of adverts, freelance designers specifically focused on creating advert content, editorial costs and so on.

As all of these may change over time, keeping a working list of costs is vital to delivering an accurate CAC figure.

How to reduce the overall Customer acquisition cost?

Business and marketing metrics need to be used in a meaningful way to achieve positive results. The best way to do this is through a unified analytics tool or smart system like Kleene.ai, where our marketing optimisation spend tools deliver valuable insights into your metrics.

Using metrics such as lifetime total value (LTV) and customer lifetime value (CLV) they deliver insights into marketing performance and your customer.

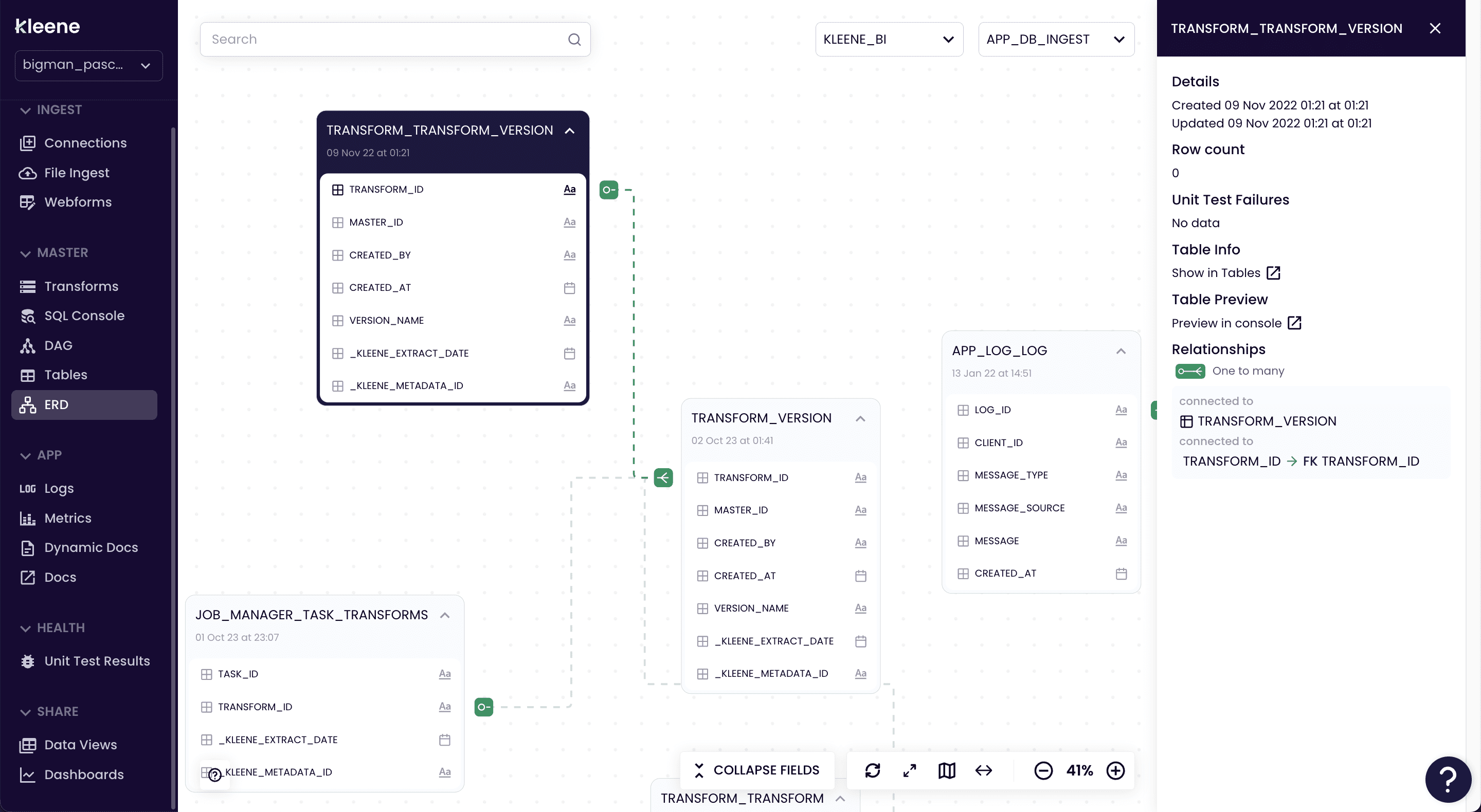

iMAGE NAME: IMAGE 7

Younger or smaller firms need to pay particular attention to the customer acquisition cost, as a high customer acquisition cost and a low CLV will rapidly create problems for the business. With those insights, you can reduce CAC by:

- Tightening focus on the most valuable or regular-buying segment.

- Retarget customers who showed an interest but didn’t purchase.

- Use marketing automation and optimisation tools to increase efficiency.

- Boost engagement across channels with value-added services, bots and smart adverts.

- Cap your advertising spend and bidding to drive more creative thinking.

If you are new to using these metrics in marketing, the good news is there are plenty of templates and apps available to do the hard work for you, as long as you have some solid data to work with. Then you can work on reducing customer acquisition costcosts and boosting sales, revenue and profit.

What are common mistakes to avoid when calculating Customer acquisition cost?

When calculating Customer Acquisition Cost (CAC), one of the primary pitfalls is dealing with poor data quality and inconsistency. It’s crucial to have a sufficient amount of data—ideally at least three months—to ensure reliable results. Inadequate or inconsistent data can lead to inaccurate CAC figures, which in turn can distort business decisions. Additionally, using data from unreliable sources or failing to align CAC data with other key metrics, such as customer segments or sales timelines, can skew the understanding of your customer acquisition efforts.

Another common mistake is omitting indirect costs and overheads when calculating CAC. Many businesses make the error of focusing solely on direct marketing expenses, overlooking other significant costs like salaries, software tools, and overheads involved in the acquisition process. This approach can result in an underestimation of the actual CAC. It’s also essential to consider hidden costs, such as technology infrastructure and data analytics tools, to get a true picture of the customer acquisition cost.

Mixing up customer types is another frequent issue. CAC should only be calculated for new customers, but some businesses mistakenly include existing customers, which can artificially lower CAC and give a misleading view of acquisition efficiency. Furthermore, failing to segment customers by factors such as geography, demographics, or acquisition channels can result in inaccurate CAC calculations, as different segments may have significantly different acquisition costs.

Misallocating personnel costs is another area where businesses often go wrong. When calculating CAC, it’s important to proportionally assign the costs of employees who work on customer acquisition. For instance, if a designer only spends part of their time on acquisition-related tasks, only a corresponding portion of their salary should be included in the CAC calculation. Incorrectly assigning 100% of the cost of part-time contributors can lead to an inflated CAC.

Confusion between CAC and other metrics, such as Customer Lifetime Value (CLV) or Cost Per Acquisition (CPA), is also common. Each of these metrics serves a different purpose, and confusing them can lead to incorrect strategic decisions. Additionally, neglecting the impact of refunds and returns can inflate CAC if not properly accounted for, as these should be deducted from the revenue associated with those customers.

Failing to update CAC regularly is another mistake that can lead to outdated and inaccurate figures. CAC should be a dynamic metric, reflecting ongoing changes in marketing strategies, costs, and market conditions. Additionally, while CAC focuses on acquisition, it’s important not to overlook customer retention efforts. High churn rates can negate the value of initial acquisition investments, making retention a critical factor in the overall effectiveness of customer acquisition.

Finally, businesses often misjudge the impact of discounts and promotions, which should be included in CAC calculations, especially if these tactics are heavily used to attract new customers. Ignoring multichannel attribution is another oversight; customers often interact with multiple touchpoints before converting, and failing to account for the cost of all involved channels can lead to inaccurate CAC figures.

By recognizing and avoiding these common mistakes, businesses can ensure that their CAC calculations are accurate and reflective of the true cost of acquiring new customers.

Tips for using Customer acquisition cost and other metrics

- You can break down customer acquisition cost into different marketing efforts, such as SEO, content marketing, affiliate marketing and other efforts to create a more granular overview of your data.

- Taking a panicked reaction and making big marketing changes based on a first CAC reading is unlikely to help matters.

- Having established a baseline CAC and CLV figures, you can segment your customers to find the most attractive demographics to market to.

- If advertising costs are pushing your CAC up, you can look for overlapping audiences, niche keywords and capping your bids to reduce the CAC.

- When changing your strategy, look across every aspect of the business, including product, marketing, sales approach and even aspects like customer support to find out where you could do things better.