In the dynamic world of ecommerce, understanding the value each customer brings to your business is crucial for sustained growth and profitability. This understanding is encapsulated in a key metric known as Customer Lifetime Value. It’s not just about the immediate profit from a sale, but about measuring and maximising the total revenue a customer generates over their entire relationship with your business. As businesses strive to allocate their marketing budgets effectively and enhance customer relationships, CLV emerges as a critical measure of long-term success.

What is Customer Lifetime Value?

Among the many ecommerce metrics, customer lifetime value is one of the most important. Gartner highlights how 25% of marketers rank CLV among their top five marketing metrics.

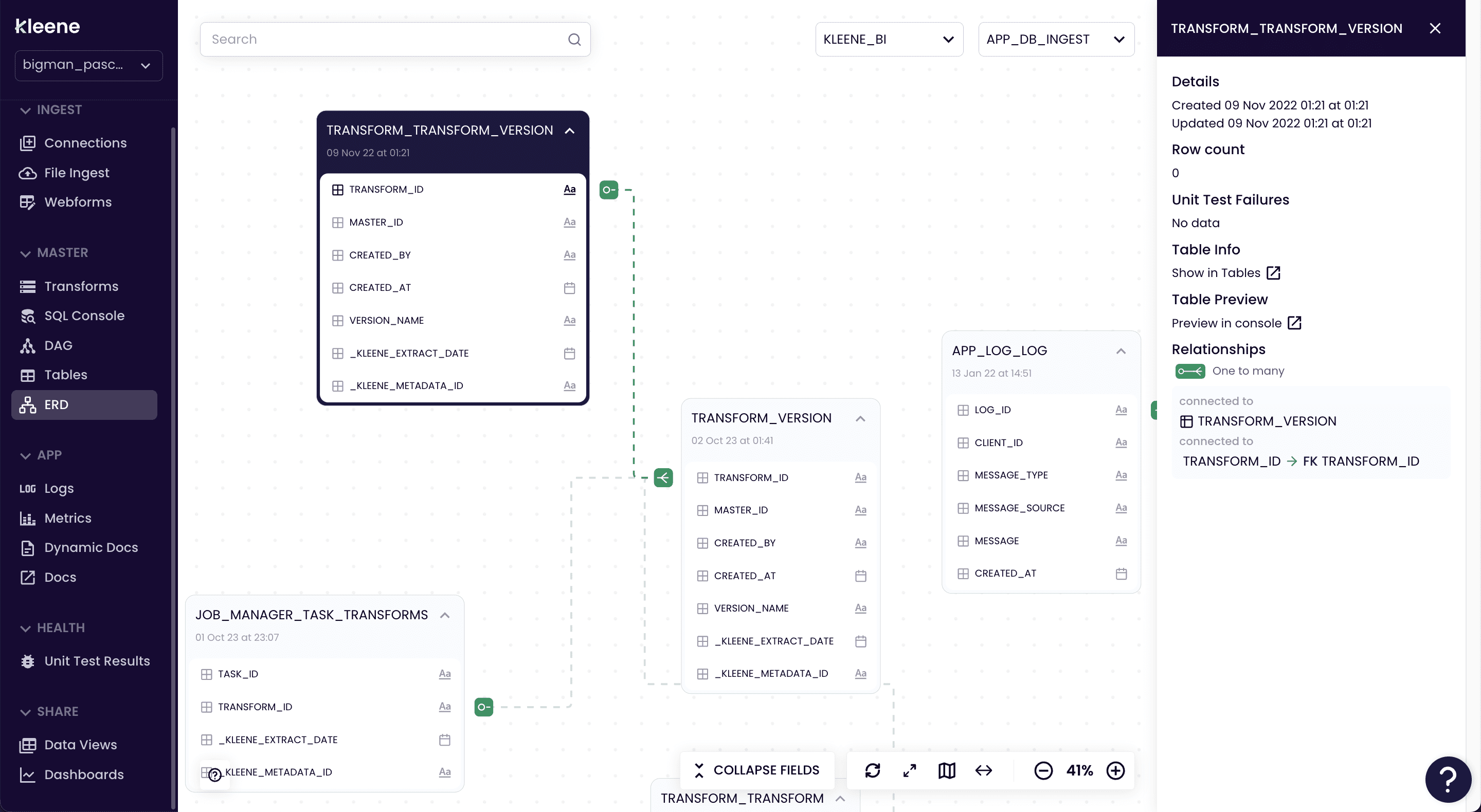

The simple sum will find your ecommerce businesses’ CLV, which you establish by finding the customer value:

Average purchase value (APV) x average total purchases

So you can now establish the customer lifetime value with:

Customer value multiplied by the average customer lifespan

With that information you can answer some of the key questions in ecommerce, no matter how big or small your business:

- Who are my most valuable customers?

- What should I do to keep raising the CLV?

- How much should I spend to attract new customers?

- Where in the customer journey are there problems?

Each ecommerce or other retailer is fighting two battles, one against rival stores, and one to keep the customers they have. Using CLV will help highlight areas to retain valuable customers, and when to change your approach.

Why is CLV an important metric for businesses?

Every business is fighting for sales and to retain customers. CLV is a key data analytics measure of how valuable and loyal your customers are. That forms the basis of how much you should spend to attract and retain them, and how efficient your business model is.

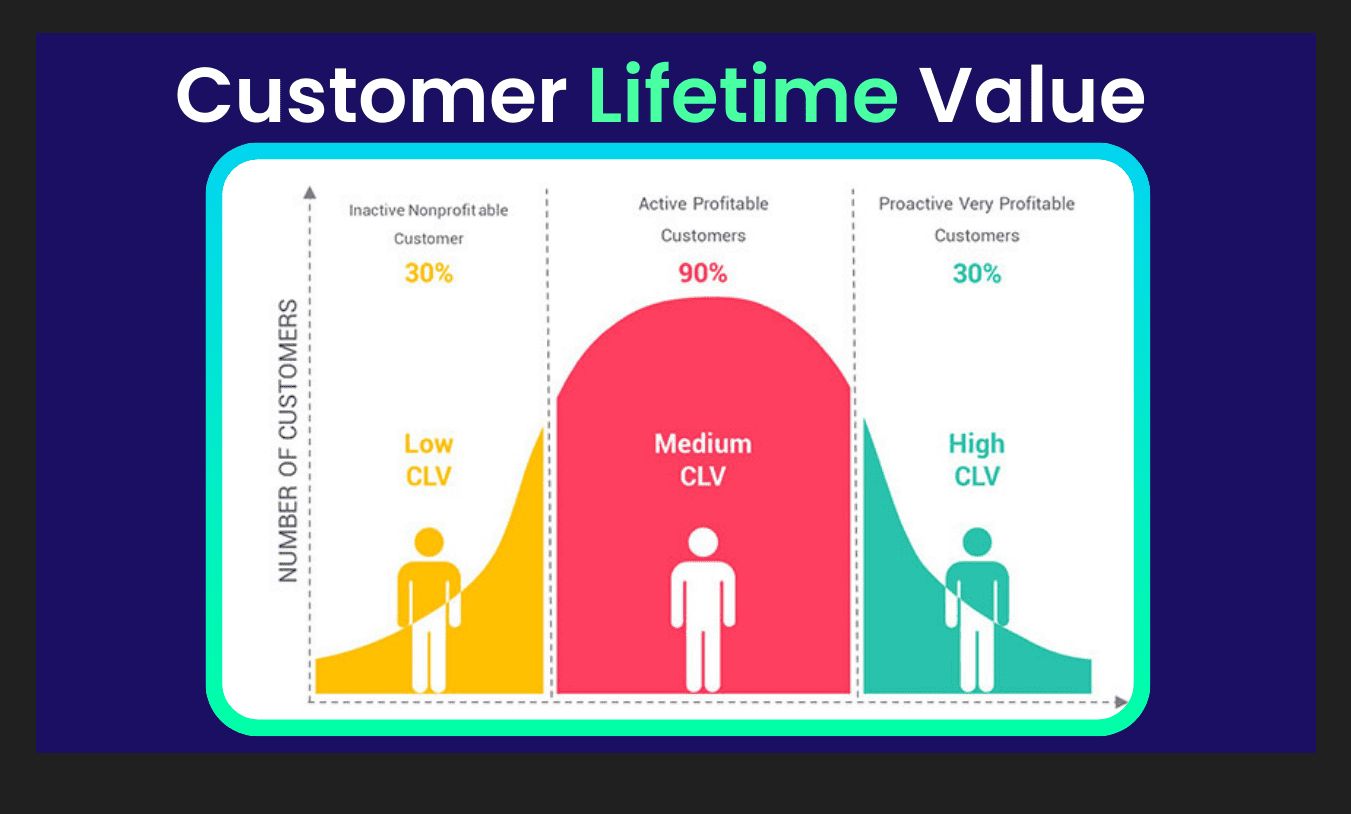

If you are spending $100 to attract customers who only spend $29 then never shop again, your business won’t last long. Similarly, if you have a core of customers who spend lots of money repeatedly, you can identify them and learn how to attract more of that type of buyer.

By being able to segment your customers, you can understand which ones are more likely to provide a better Return on Ad Spend (ROAS), and you can adapt your strategy accordingly. If you want to find out more about ROAS click here.

How does Customer Lifetime value help in making informed business decisions?

Customer Lifetime Value (CLV) is a crucial metric for assessing the profitability of your business. At its core, CLV reveals whether your business model is sustainable. For example, if your average CLV is lower than the cost of acquiring customers, it signals that your business may not be profitable. This insight allows you to make strategic changes, such as optimizing marketing spend, increasing customer retention efforts, or enhancing sales strategies to boost growth and improve overall profitability.

Beyond assessing profitability, CLV plays a significant role in tracking the customer journey and aligning it with your marketing efforts. For instance, if you notice that customers with a higher Customer Life Time value are those who engage with specific features of your product, you can tailor your marketing campaigns to emphasize these features, potentially increasing the overall CLV of your customer base. By understanding the metric, you can analyse customer behavior to generate stronger cash flow and design future marketing strategies that are more effective.

However, for CLV to provide meaningful insights, it’s essential to have reliable and substantial customer data. A new business with only a few weeks of sales data, for instance, may not have enough information to accurately calculate life time value. Furthermore, to compare different customer segments effectively, it’s important to ensure that the customer lifespans are similar. Identifying loyal customers, who often contribute to a higher CLV, requires additional data from your CRM or other reliable sources.

For example, a business might discover through CRM data that its most loyal customers—those who frequently renew subscriptions or make repeat purchases—also tend to refer new customers, further increasing their overall CLV. This insight can lead to targeted loyalty programs or referral incentives, ultimately driving long-term business growth.

Historical vs predictive customer lifetime value calculation

With smart tools available to all types of ecommerce business, many are not resting on the information provided by a CLV calculation that works on your historical data. A predictive model uses machine learning to generate indicators of future performance and goals.

Using predictive CLV powered by an AI, you can adjust your marketing campaigns and their budgets as they track toward or away from your CLV goals. That enables you to invest more in marketing and products that are going to perform better.

If your current marketing tools don’t provide predictive analytics, consider Kleene.ai with its decision intelligence platform to provide advanced AI tools like predictive CLV and other metrics to put you ahead of the competition.

How do you factor in discounts when calculating CLV?

Many ecommerce businesses use discounts to tempt customers and generate repeat business. See “How Discounts Affect Customer Lifetime Value” for details of the impact and size of discounts and how they affect CLV. Discounts can skew CLV scores somewhat, so there’s a different equation to factor that in.

CLV = (average purchase value x average purchase frequency) x (1 – Churn Rate) / (1 + Discount Rate – Churn Rate)

This can factor in subscriber discount rates, money off sales and other enticements to drive sales, that may boost customer value in the long term, even at a small cost in the short term.

How to Boost Your CLV Score?

Your CLV score is one key metric that you can focus on to boost business. There are many ways to improve it, with some insight from other data needed. For example:

1 Identify high-value leads in your funnel and focus on converting them into customers

2 Increase conversion rates among your existing customers with offers and focused marketing

3 Avoid churn with a major focus on customer retention

4 Optimize customer lifetime value through sales incentives and value-added extras

5 Use lead scoring, and conversion rate and retention rates, alongside CLV to track performance

Ultimately, the more data you have, the better your ecommerce business will perform, but ensure you are using the right metrics and calculations to meet your objectives and create achievable goals for the future.

What’s the Difference between CLV and LTV?

Lifetime value (LTV) is a similar metric, often mistaken or used instead of CLV.

The key difference is that CLV focuses on each customer and their value to the business, while . LTV gives an overall value for all of your customers. That more general view is more useful for larger ecommerce and SaaS firms with high volumes of turnover.

Small ecommerce firms with a limited resource of high-value customers will want to focus on them and watch their CLV grow.

If you need help understanding marketing and ecommerce goals then our experts at Kleene can help guide you in how to use data to make the best business decisions.

Want to learn more? there are three other ways you can get value from Kleene.ai:

- Download our “A Step-By-Step Guide to Getting From Raw Data to Decision Intelligence” eBook

- Watch our free on demand webinar with Bella & Duke, analysing their growth blueprint and how they optimised their LTV/CAC

- Book a call with an expert and learn how retailers are achieving automated decision intelligence https://kleene.ai/talk-to-an-expert/