While ecommerce might seem a low-cost way to reach huge audiences, nothing online is free, so understanding the difference of CAC vs CPA is vital for successful stores.

Everything online costs something, with advertising campaigns, lead generation, marketing efforts and even sales analysis all adding drag to the bottom line. The most successful stores aren’t always those with the best products or services, although that helps, but those with managers who understand the ecommerce landscape and extract the maximum value from their customer and sales data.

Using customer acquisition cost (CAC) and cost per acquisition (CPA) are just two key metrics that help establish the underlying health of an ecommerce store or business.

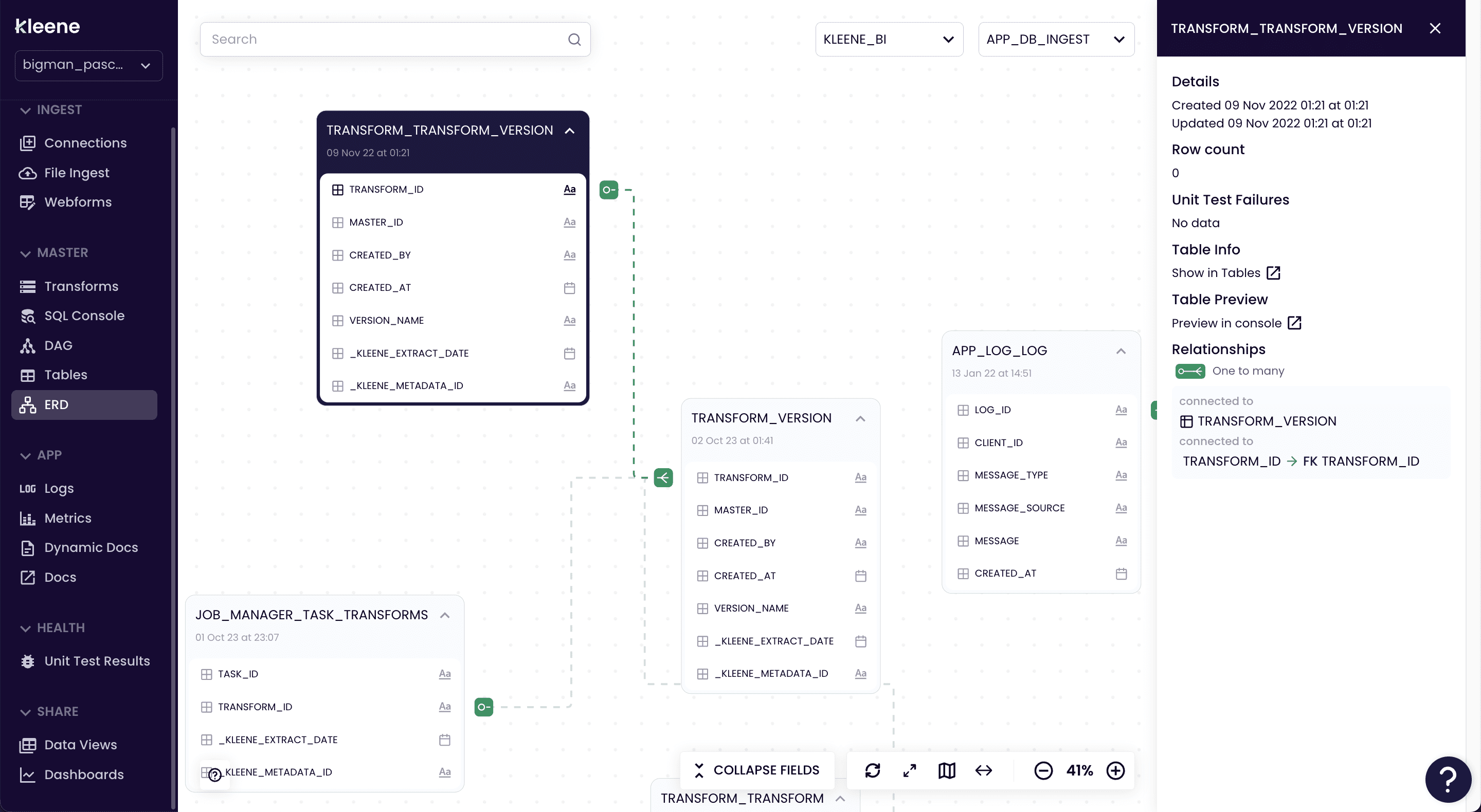

What is Customer Acquisition Cost (CAC) and How to Calculate it?

Self-explanatory it may be, but CAC is vital to understand how your business is growing. If it costs $100s to bring in $10-spending customers, your operation won’t last very long.

Calculating the customer acquisition cost is simple, it is the total spent on sales and marketing efforts to attract customers divided by the number of customers your business gained from those promotions.

It might sound simple, but with pay-per-click, dynamic advertising and potentially complex marketing costs, plus human resources, you need to keep a tight track on spending to deliver a useful CAC value.

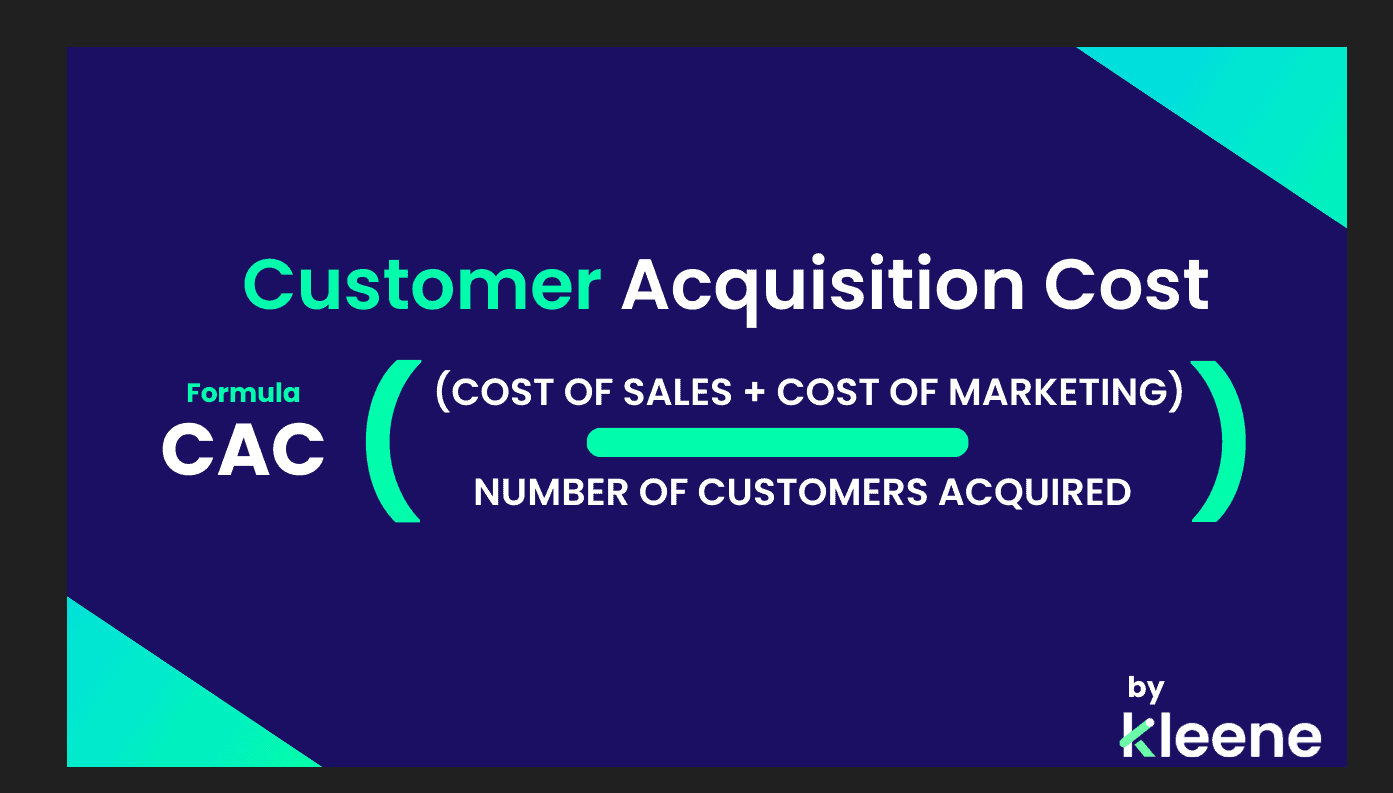

CAC VS CPA: What is Cost Per Acquisition and how does it differ from Customer Acquisition Costs?

A slightly different metric, CPA is a shorter-term focused figure to establish the cost of new customers within a specific campaign. The math is simple too, the cost of the campaign divided by the number of new sign ups.

By establishing the CPA you gain insights into the cost to get your prospects or customers performing a specific action or achieving a particular outcome.

CAC VS CPA In what scenarios is CAC used as opposed to CPA?

At their simplest, the CAC is the strategic view of your marketing activity while the CPA is the tactical overview of one specific campaign.

CPA is also used to identify leads, not just paying customers, which is where CAC comes into play. The value of leads and lead generation are vital for growth, so early-stage ecommerce businesses can focus on CPA while broader-focused established stores can use CAC to track sales trends.

Used alongside other metrics like lifetime total value (LTV), and customer lifetime value they provide a rounded view of your business and marketing performance.

How do CAC VS CPA provide different insights into marketing effectiveness?

1. CAC Insights

Customer Acquisition Cost (CAC) measures the total expense required to acquire a new customer. This includes all marketing, sales, and advertising costs involved in converting potential customers into paying customers.

- Channel Effectiveness: CAC helps identify which acquisition channels are most cost-effective in attracting new customers. By comparing CAC across various channels, businesses can determine where to focus their marketing budget for maximum efficiency.

- Budget Allocation: With insights from CAC, businesses can strategically allocate their resources to the most effective channels, ensuring that their marketing spend delivers the highest return on investment (ROI).

- Customer Segmentation: Analyzing CAC across different customer segments provides valuable information about which segments are the most profitable to target, allowing for more focused and effective marketing strategies.

2. CPA Insights

Cost Per Acquisition (CPA) measures the cost associated with acquiring a specific action from a potential customer, such as a sale, signup, or lead. It is a crucial metric in performance-based marketing.

- Campaign Performance: CPA provides insights into the effectiveness of individual marketing campaigns. By tracking CPA, businesses can determine which campaigns are generating the most cost-effective conversions and which may need optimization.

- Tactical Optimization: CPA helps pinpoint which specific marketing tactics, such as ad creatives or targeting strategies, are driving conversions at the lowest cost. This allows marketers to fine-tune their approaches to improve performance.

- Scalability: Monitoring CPA over time enables businesses to assess whether their marketing strategies are becoming more efficient as they grow, with the expectation that CPA should decrease due to improved tactics and economies of scale.

3. Evolution of Metrics Over Time

Customer Acquisition Cost (CAC) and Cost Per Acquisition (CPA) offer complementary insights, but their evolution over time reveals different aspects of marketing effectiveness:

- Interplay Between CAC and CPA: Over time, businesses should aim to see both CAC and CPA decrease as they scale and refine their strategies. Lower CAC indicates more efficient use of resources across acquisition channels, while lower CPA reflects more effective campaign execution. Together, these metrics provide a comprehensive view of marketing effectiveness, from high-level strategy to day-to-day tactics.

- CAC Trends: CAC tends to be more stable and is typically analyzed over longer periods. As businesses refine their customer acquisition strategies and improve brand recognition, they aim to reduce CAC. Tracking this trend over time helps businesses assess the impact of their strategic decisions and the sustainability of their acquisition efforts.

- CPA Fluctuations: CPA, on the other hand, can fluctuate more frequently, reflecting the immediate performance of individual campaigns. As businesses optimize their marketing tactics and achieve better targeting, CPA should ideally decrease. Monitoring these changes in CPA allows for quick adjustments to campaigns, ensuring they remain cost-effective.

Factors that impact your CAC score

When using your CAC score to track marketing results, you need to pay attention to the various factors that can change the score, these include:

- The various marketing channels and costs across search, types of advertising, content marketing efforts and other efforts all impact CAC.

- Reaching out to different target audiences will impact the cost of advertising, with premium audiences costing more.

- Similarly, markets with great competition will see advertising prices soar for specific keywords and bids, especially for premium products or where you compete with major brands.

- The game goes for playing in particular industries or geographic regions, being smart with your marketing can reduce the cost of CAC.

Factors that impact your CPA score

The size of your budget is the primary factor in keeping your CPA score down. Beware that as budgets grow, your CPA could boom with them.

As with CAC, the choice of marketing effort will impact the CPA, traditional CPA advertising campaigns are often augmented with affiliate marketing or social media campaigns that add to the cost.

CAC VS CPA: can they be used together for a broader view?

With dozens of marketing metrics out there, it is unfair to ignore one over another. Each one reinforces or augments others, so it makes sense to use every tool at the marketers disposal to get the best possible picture.

Using tools like Kleene.ai can help you gather all the data at your disposal and make the best decisions through smart suggestions. If your current marketing tools don’t provide predictive analytics, our decision intelligence platform delivers advanced AI tools to deliver valuable insights.

CAC VS CPA: How to improve them

Marketing automation is fast taking over from traditional methods, and to compete your need to be using automation and AI tools. But marketing isn’t all about the robots. You can use customer retention strategies to reduce the cost of hunting for new customers.

And across the business, good customer support, product improvement and service value will all boost the money that customers spend, and improve loyalty.

Ultimately do not be a slave to the metrics, focus on your business, its offerings and what you do best to deliver the best products and service you can. Armed with that mindset, you can use the CAC and CPA metrics to deliver powerful analytics-led marketing to boost your metrics and see better sales results.

Want to learn more? there are three other ways you can get value from Kleene.ai:

- Download our “A Step-By-Step Guide to Getting From Raw Data to Decision Intelligence” eBook

- Watch our free on demand webinar with Bella & Duke, analysing their growth blueprint and how they optimised their LTV/CAC

- Book a call with an expert and learn how retailers are achieving automated decision intelligence https://kleene.ai/talk-to-an-expert/