In any business, understanding and maximising the value of customers is crucial. Companies invest in marketing, sales, and customer service to acquire and retain customers. However, not all customers are equally valuable in the long term. Some might make a one-time purchase, while others become loyal, repeat customers. The challenge for businesses is to identify how much value each customer brings over their “lifetime” and strategise accordingly to maximise this value.

This is where the concept of Lifetime Value (LTV) comes into play. LTV helps businesses make informed decisions about how much money to invest in acquiring new customers and retaining existing ones, and it’s crucial for evaluating customer relationships’ profitability.

What is Lifetime Value (LTV meaning marketing)?

Lifetime Value (LTV) is an aggregate measure that shows the amount that customers will bring over the total time they interact with your company. LTV can vary across many types of customer segments, businesses, and transactions. In the world of software as a service (LTV SaaS), it relates to the income from customers in repeatable subscriptions for your product(s), whereas in retail, it relates to how many times your customers acquires products from your store in a certain period of time.

As a general example , one customer might visit a bakery every day, spending small but regular amounts. They might visit a gas station twice a month to fill up, but the near auto shop once a year for an expensive service.

In small-scale businesses, that information might be easy to track through loyalty cards, identity methods, and staff knowledge, but it can be hard for the business to process and harder to establish how to maximise revenue based on the same information.

At a full-business scale, identifying LTV across all customers can help drive performance goals and improve acquisition strategies. Most calculations are based on historical data, but progressive companies, especially those with high numbers of customers like SaaS or retailers can create predicted values using machine learning tools.

Consider the likes of Amazon or other large online retailers which have massive amounts of data about every customer. What items they browse, what they look at on web pages, products they buy, and regular purchases. Through tracking and based on personal information, they can generate a staggering range of other insights.

In the digital retail and SaaS world, businesses can increase lifetime value through regular offers, tempting coupons, usage reminders and other methods. With the scale of online, knowing your LTV can boost and build a thriving SaaS business, or encourage a pivot to more profitable products or models.

The likes of Forbes have long been promoting LTV as one of the key metrics to understand for marketers and business owners. Along with the customer acquisition cost (CAC), it is essential to understand your market, customers and prospects. Another useful metric is return on ad spend (ROAS), click here to learn more.

How to Calculate Lifetime Value?

The simplest way to find your lifetime value statistics is to calculate the average purchase value divided by the time period they have been a customer.

- So, if a customer bought 6 products for $100 in the first 6 months and then 6 for $150 in the last 6 months of the year, we have 600+900/12 for an average purchase value of $125.

- Next, we need an average purchase rate (how many products they buy), say three products per month.

- Finally, the lifetime of the customer, let’s say 2 years.

- Multiply them together and you get your LTV (125*3*2=$750)

Another way to create your LTV is by taking the average revenue per user (ARPU) = revenue/total customers (within matching time periods).

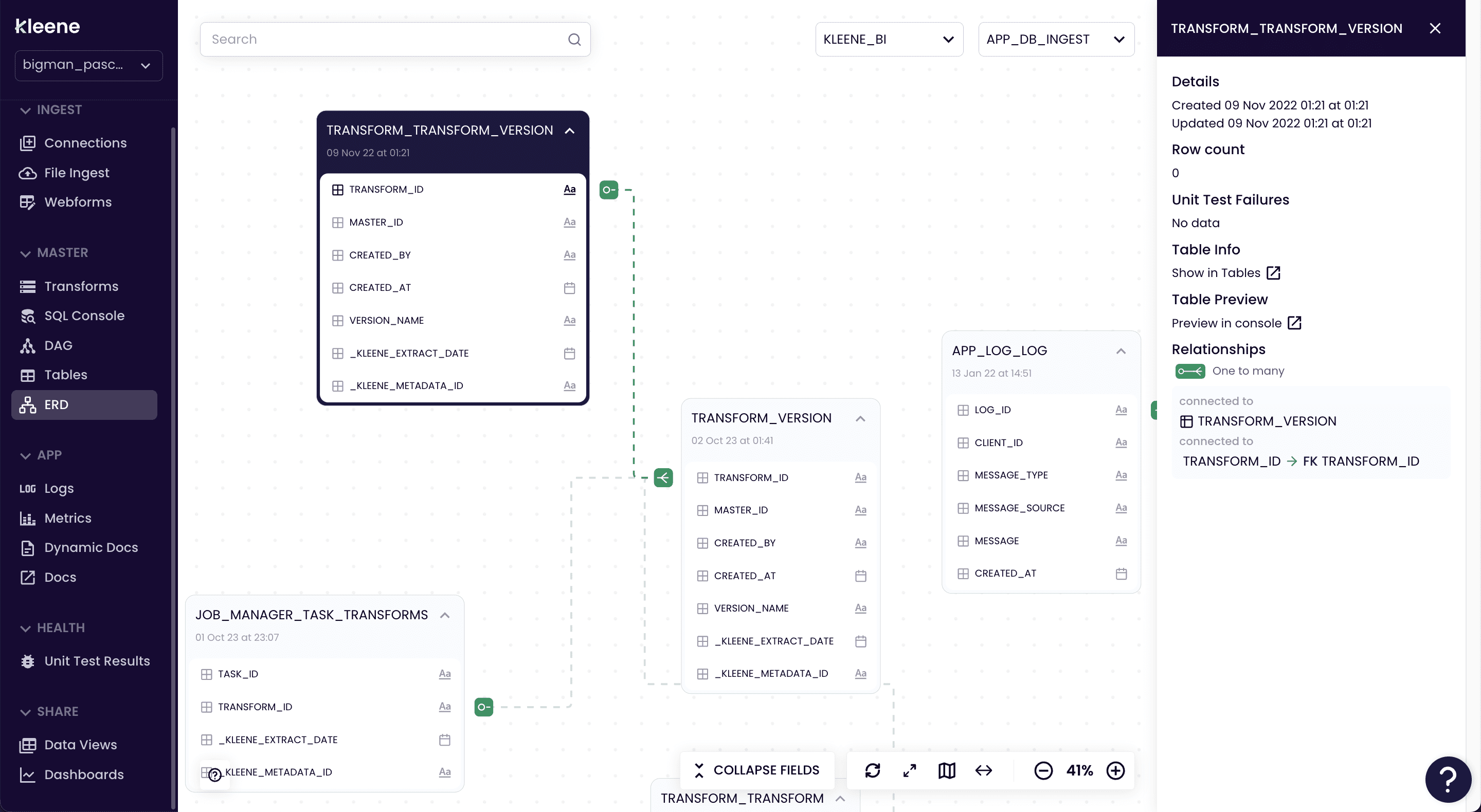

IMAGE NAME: TYPICAL LTV CALCULATION

Churn’s Role in LTV SaaS

In most SaaS products, churn plays a significant role in revenue, as the loss of customers directly affects the long-term viability of the business. To calculate churn rate, a simple formula is used: divide the number of lost customers by the total number of customers during the same time period, then multiply by 100. This percentage reflects how quickly customers are leaving your service.

A rising churn rate is a critical signal that requires immediate attention. It’s essential to engage both acquisition and retention teams to investigate the underlying reasons for churn and to identify characteristics common among customers who are likely to leave. These teams can work to reduce churn by offering incentives, emphasizing the value proposition of the service, and communicating the roadmap of upcoming features that may retain customers.

In SaaS businesses, early indicators of potential churn include customers who are disengaged, those not utilizing all their available seats, or a significant drop in product usage. Identifying and addressing these signs early on can help prevent customers from leaving, ultimately protecting the long-term value (LTV) of the customer base.

What Questions Does LTV Data Generate?

Through tools like retail analytics, marketers can drive growth for their business by asking and answering a range of questions.

The first will be what is the best churn period to monitor? For retailers that might be on a quarterly basis, but can stretch to six months or annually depending on need.

When you have customer and broader LTV data, you can also establish your higher value customers and ask create strategies to keep them longer?

As a key metric, LTV is vital in solving several parts of the Retails puzzle. It is key as business intelligence plays a role in driving growth and maintaining a competitive advantage over your rivals. As efficiency becomes the feature for retail companies and their proposition, focusing on these metrics is more important than ever .

What is the Benefit of Knowing Your LTV?

Based on LTV and similar information (such as CLV )you can decide how much to spend on acquiring new customer but also when to change focus on other efforts such as upselling, to drive growth.

Additional benefits of knowing LTV are that it include:

- Budgeting and your spending plans

- Lead generation, in knowing what roles/audience to focus on

- Upgrade and upsell offers to those showing signs of churn

- Campaign building, based around new sign-ups or upgrades

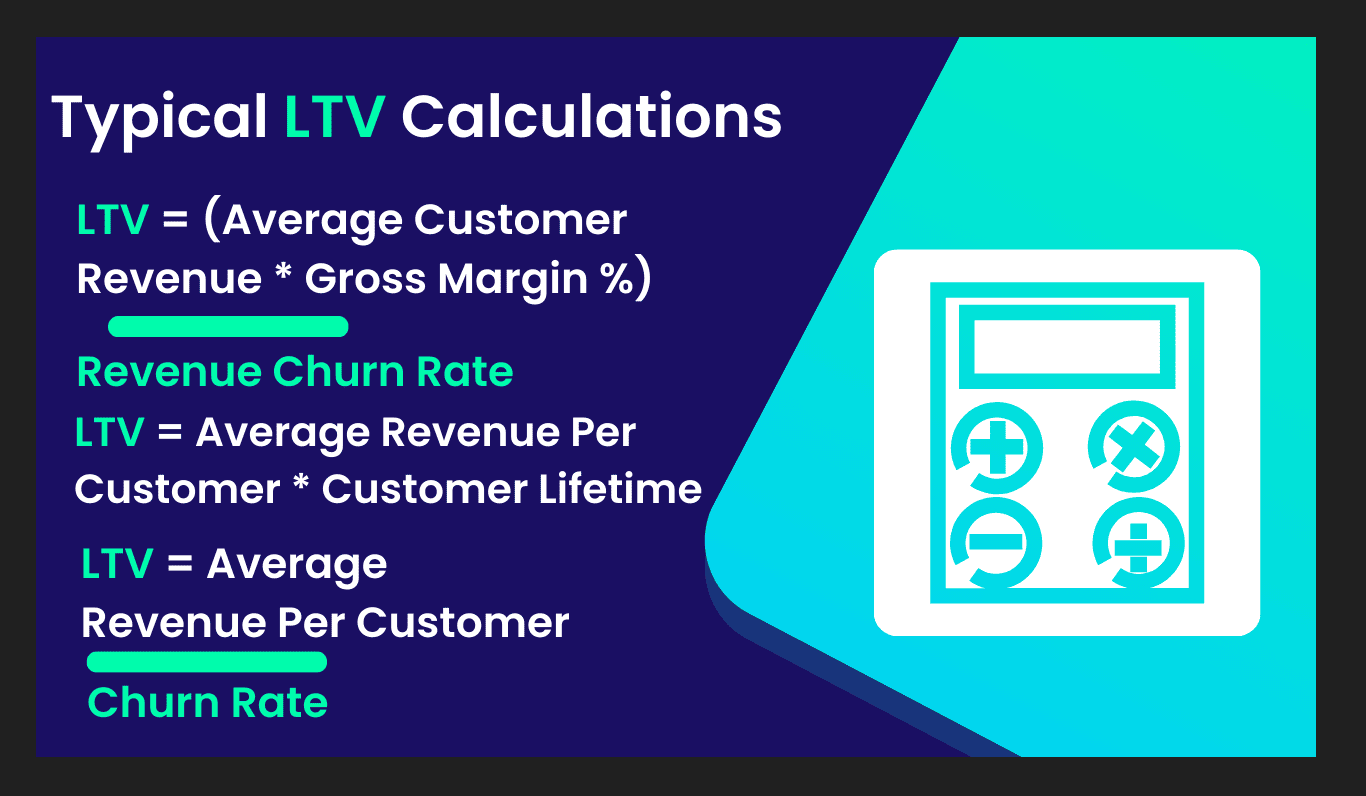

With more data points needed to track business performance, many companies are turning to decision intelligence to gather data and provide insights into how to boost their performance. Services such as Kleene.ai provide the platform for you to build your decisions on solid data, faster and with less delay than traditional marketing and metric tools.

Kleene helps decision-makers make smarter, faster decisions, based on AI recommendations that are built on data from across the business for a powerful competitive advantage. If you need help setting valuable goals, our experts at Kleene can guide you in the best metrics to focus on delivering high-value results.